Portfolio Stress Testing In Anaplan

July 17, 2024

Leverage dimensional planning tools to evaluate the impact of changing market conditions in real time

In our dynamic and changing market conditions, frequent portfolio stress testing has become an essential component of risk management and planning processes.

Why stress testing commercial real estate portfolio is important

In our dynamic and changing market conditions, frequent portfolio stress testing has become an essential component of risk management and planning processes.

-

Identify vulnerabilities

Illustrate how investor portfolio’s perform under interest rate hikes, changes in occupancy and leasing assumptions. Isolate performance based on market, property type, and other attributes.

-

Assess Liquidity, Cashflow & Performance Impacts

Monitor impacts to projected lender covenants, performance to target investment objectives

-

Inform Decision-Making

Adjust portfolio composition, exit underperforming assets, and build better portfolio resilience

What makes it challenging?

Performing portfolio wide scenario analysis across a large commercial Real Estate portfolio is a challenging and time consuming process, requiring high levels of manual spreadsheet work and the consolidation of results across multiple workbooks.

This process is typically time-consuming, error prone, and as a result not performed on a recurring basis.

Consequently, many Real Estate Asset Managers are looking to new technologies to support this process, enabling frequent and valuable stress testing to be performed without the additional burden to operations and financial reporting processes.

Lionpoint’s Commercial Real Estate Anaplan Accelerator

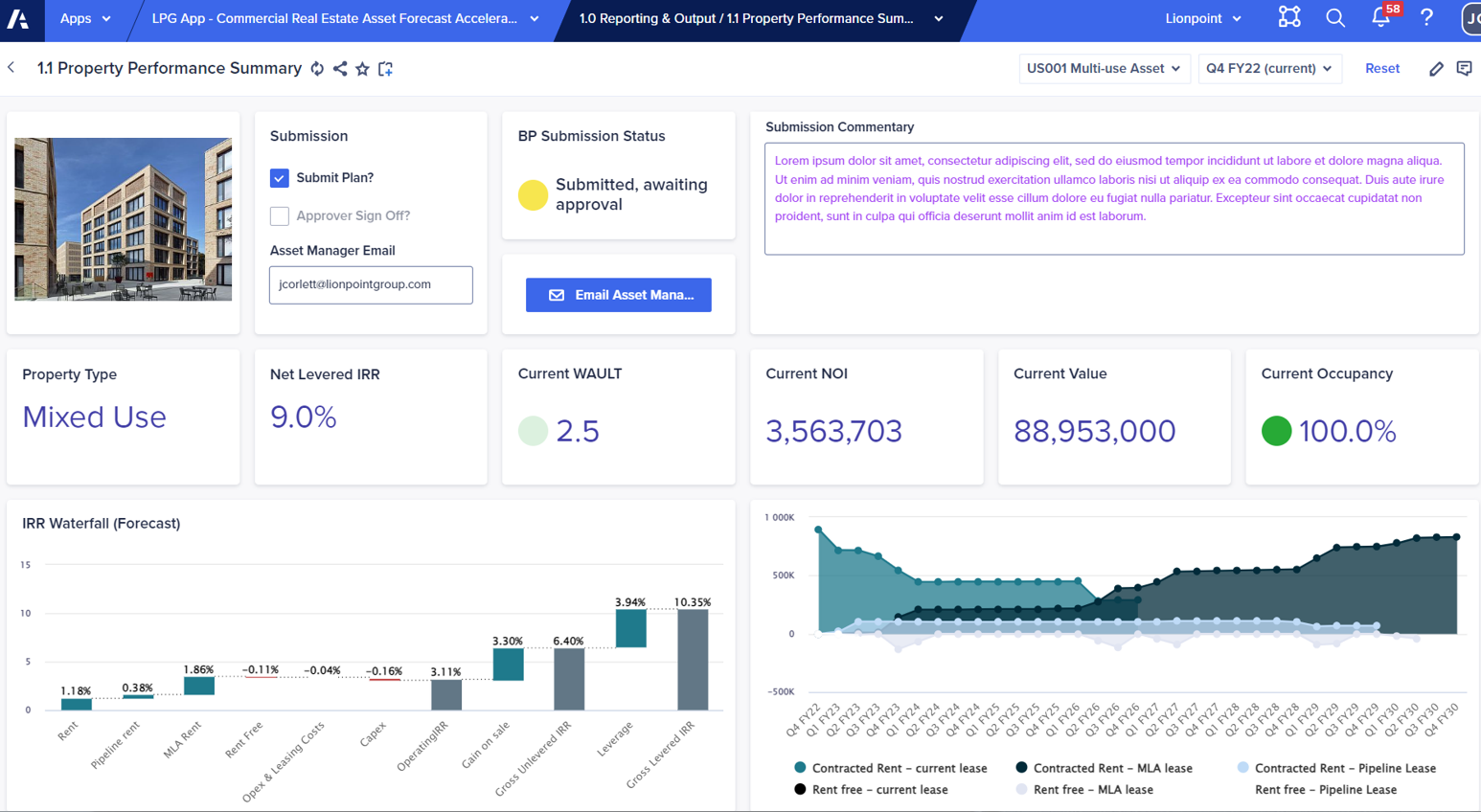

In response to this industry challenge, Lionpoint has leveraged Anaplan to enable real-time portfolio stress testing across a regional Commercial Real Estate portfolio.

-

Flexible analysis:

Apply shifts on rent growth, indexation, exit yield, market leasing assumptions, and reference rates. Target shifts to specific countries and property types.

-

Real-time impact assessment:

Review cashflow and performance variances across the portfolio, for sub-portfolios, and single investments.

Next Steps

If you are interested in finding out more about how Lionpoint can help you with your Portfolio stress testing analysis by leveraging a best in class Cloud-based planning solution, please contact us:

Neil Elliot, Senior Partner: nelliot@lionpointgroup.com

Joe Corlett, Partner: jcorlett@lionpointgroup.com